Amazon has spent the better part of a quarter century forcing retailers of all stripes to innovate, speed up and compete. The company premised its great disruption on its laser focus on the customer — easing the process of shopping and paying, winnowing delivery times to a couple days or less, and slashing prices.

But the e-commerce giant’s effect on the sector appears to be waning to some extent. Rivals like Walmart and Target have done a lot of catching up, boosting their e-commerce and leveraging their many stores. Independent retailers, including the bookstores that first encountered Amazon as a new competitor, have survived. While Amazon still dominates online sales in the U.S., with some 40% share according to eMarketer, brick-and-mortar stores still drive 85% of all retail sales, according to the U.S. Department of Commerce. E-commerce also remains an expensive way to sell products, including at Amazon, which last month warned that profits could vanish in the holiday quarter.

In fact, after surging during the height of the pandemic, Amazon’s retail sales floundered all year, and it appears to be scrutinizing its operations. Under new CEO Andy Jassy this year, the company shuttered most of its non-grocery physical stores. The company also canceled or postponed dozens of warehouses planned in an expensive expansion of its fulfillment capacity.

More recently, Jassy is overseeing massive layoffs and hiring freezes, much of them in retail. He is said to be reviewing underperforming business ventures like voice assistant Alexa, which reportedly has failed to produce the expected volume of orders from users. Founder Jeff Bezos, who until he stepped down last year as chief executive annually penned a letter promising investors that it remained “day one,” might see this new era as “day two."

Amazon now joins other retailers in grappling with how to adjust to the continual evolution in retail. Its tech strength and focus on speed and efficiency are no longer enough to win in this business, according to Doug Stephens, author of “Resurrecting Retail: The Future of Business in a Post-Pandemic World.”

“Not only has the retail world closed the gap with Amazon, but the very nature of e-commerce has also fundamentally changed,” Stephens said by email. “Increasingly, retail is not something that resides on static, boring, search-driven websites (like Amazon.com). It now lives inside interesting, entertaining and engaging content and communities of interest. All things Amazon has never been very good at developing.”

The customer

Amazon has made itself indispensable to legions of consumers, chief among them those paying $140 for its Prime membership. Members get their orders delivered as quickly as one day in some places and enjoy perks like streaming entertainment. But there are some cracks in that formidable base.

“Not only has the retail world closed the gap with Amazon, but the very nature of e-commerce has also fundamentally changed."

Doug Stephens

Founder, Retail Prophet

Prime membership looks to be plateauing in the U.S., where penetration has stalled at 77% in the last two years, according to June research from Evercore analysts. The company may have to look abroad to grow Prime, they said.

More concerning to analysts are emerging signs of discontent. Amazon remains the most commonly used retail site, with 94% of survey respondents saying they use it, the highest level in eight years, according to Evercore. But those analysts also found satisfaction sliding of late, with 79% of Amazon customers “extremely” or “very satisfied.” That’s a recovery from lower levels during the height of the pandemic, but it’s well below 2013’s 88%, according to the report.

Consultancy Brooks Bell uncovered some of the issues. Nearly a third of those surveyed by the firm earlier this year said they got their order late or received a low-quality product from Amazon at least monthly. Meanwhile 44% said the item they wanted wasn’t in stock at the “everything store,” and 36% said they couldn’t find what they were looking for quickly. And many consumers see better alternatives: Nearly half said they’d rather support small businesses than shop at Amazon, while 36% go elsewhere for product expertise, per Brooks Bell’s report.

Evercore attributes the rising level of disappointment to “Amazon’s aggressive expansion of its third-party marketplace to lower-quality international sellers and its increasing rollout of advertising inventory in its product search results” as well as delivery delays.

Amazon declined to make anyone available to be interviewed for this story. But in an email the company said it continues to “invest and prioritize creating the best retail experience for customers,” pointing to its October Prime Early Access Sale, which many referred to as a second Prime Day event. That sale raked in an estimated $8 billion in gross merchandise volume, 25% less than its July Prime Day and below expectations. Amazon also said it just hosted “the biggest holiday shopping weekend ever” over Black Friday and Cyber Monday, although it hasn’t shared specifics.

The competition

Most retailers have had to respond to the fierce competition from Amazon over the years, and their efforts have borne fruit.

Walmart has borrowed many of Amazon’s ideas, devising a Walmart+ membership with speedy delivery and other benefits, nurturing a third-party marketplace and growing an advertising business, for example.

“It took them a long time, but Walmart is now basically copying Amazon's playbook,” Rick Watson, founder and CEO of RMW Commerce Consulting, said by phone. “The only thing that they haven't copied is AWS, which they can't really do. But advertising, fulfillment, marketplace, that's straight out of Amazon’s playbook. They're not really doing anything unique. Their answer is just to wait and see what works at Amazon and copy it. And, look, it seems to be working for them, and they're more profitable right now.”

AWS is Amazon’s cloud services unit, a booming tech business that boasts several government and corporate entities as clients and has been consistently more profitable than its retail sales.

“It took them a long time, but Walmart is now basically copying Amazon's playbook."

Rick Watson

Founder and CEO, RMW Commerce Consulting

Retailers have responded to the demand for swifter delivery and easy online shopping, as when Target bought home delivery service Shipt in 2017 to foster omnichannel services and developed its app. But they have also embraced their traditional strengths. Walmart, Target and other chains have leveraged their stores for fulfillment and pickup services, a lesser advantage for Amazon, whose fleet is mostly Whole Foods grocery stores.

“Target found its own path,” Watson said. “Everything runs through their stores. I've always been super impressed by what they've done, trying not to copy Amazon.”

The physical store itself is a differentiator, and Target and others have made a point of spiffing up their stores, differentiating their merchandise and offering stellar in-person customer service. Independent booksellers — operating in Amazon’s debut retail segment — have by and large survived, demonstrating that affinity for buying local can outshine Amazon’s convenience and price plays. Amazon in fact has throttled back on non-grocery physical stores, closing all bookstores and 4-star locations earlier this year.

“Clearly, most of these stores in categories such as bookstores lacked elements of innovation or driving in-store engagement or experience,” Euromonitor Senior Consultant Rabia Yasmeen said by email. “Even its grocery stores ... are focused on payment capabilities, cashier less or self-checkout – and still hold room for integrating its online operations with offline presence.”

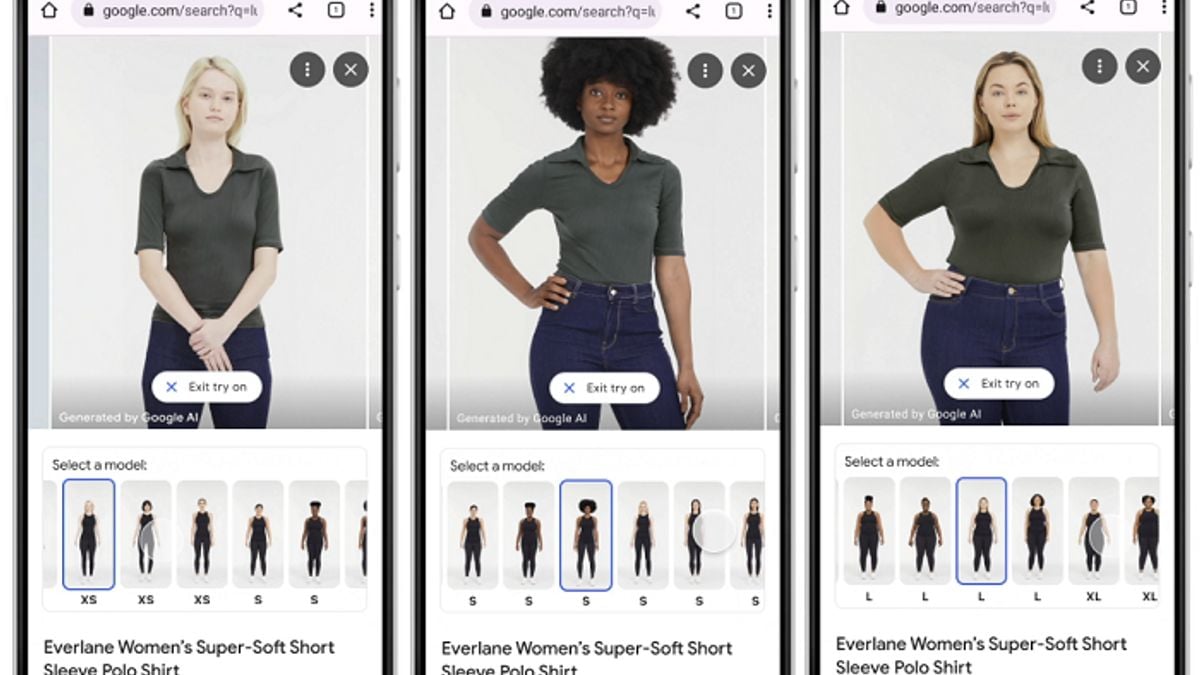

In an email, Amazon said that despite the closures it remains “committed to building great, long-term physical retail experiences and technologies.” The company has opened a couple of apparel stores this year, though The Guardian in July said the Los Angeles location “misses the point of shopping.” Watson sees them as potentially effective testing grounds and showcases for their technology, including AI-driven suggestions and smart dressing rooms, but “terrible” venues for selling clothes.

The strength from rivals doesn’t just come from the physical landscape, however. On Black Friday this year, Walmart, Target and Kohl’s all outpaced Amazon in online searches for deals, toppling the e-commerce giant from the top spot, though Amazon kept its number-one position on Cyber Monday, according to data from Capitfy.

Is this retail?

Several experts interviewed for this story pushed back on the idea that Amazon is anywhere close to finished disrupting retail.

“Many people look at where Amazon is now and forget that each step they took over the last 20 years to win the customer’s business never made immediate impact to their bottom line,” Forrester Principal Analyst Brendan Witcher said by email. “Amazon has incrementally been building an ecosystem of connections into our lives that will help them better sell to us. Within that strategy is the disruption that is the most impactful because it is almost too hard to see or compete against until it is too late.”

Indeed, unlike when it launched in 1994 as a book e-retailer, most of Amazon’s growth and profit now derives from operations outside its sales of products. Those streams include advertising, third-party seller fees, subscriptions and its cloud business. Last year, the first time it disclosed its advertising revenue, Amazon took in $31.2 billion selling ads, which are featured in its streaming and gaming entertainment and its retail site. Moreover, nearly 60% of the goods sold on its site actually come from its third-party seller marketplace.

“Amazon has incrementally been building an ecosystem of connections into our lives that will help them better sell to us. Within that strategy is the disruption that is the most impactful because it is almost too hard to see or compete against until it is too late."

Brendan Witcher

Forrester Principal Analyst

Stephens notes the company is also building operations in medicine, finance, insurance and education.

“If they are successful, that would create an infinitely more lucrative structure than simply pursuing a larger and larger retail marketplace,” he said. “Even a small percentage share of the global healthcare market could rapidly eclipse the value and profitability of Amazon's retail enterprise.”

According to Witcher, that proximity to the consumer remains a concern for the industry.

“The real competitive advantage Amazon has over Walmart and Target isn’t in their retail capabilities (like how fast they can get us products),” he said. “It is in their ability to sell to us anywhere and anytime as we digitize our lives through our homes, cars, and our mobile interactions.”

A host of retailers including Hudson’s Bay, Saks Fifth Avenue and Macy’s have followed Amazon and Walmart in creating marketplaces, while others, including Nordstrom, are boosting revenue with advertising. But how far from retail — the business of merchandising goods to sell to customers — are retailers willing to stray? And how willing are they to continue to compete with a rival able to forgo profits in its retail business?

To other analysts, Amazon has only disrupted retail as far as retailers have allowed, which has led them to pursue money-losing endeavors, without the cushion of lucrative side businesses like cloud services or the patience of their investors. Nick Egelanian, president of retail development firm SiteWorks, compares e-commerce to another non-store retail segment, catalogs, which he said contributed 10.9% of retail sales in 1994, the year of Amazon’s founding.

“Amazon never disrupted retail any more than Sears and Spiegel did with their catalogs,” he said by email. “But e-commerce is unprofitable under the current model. While Amazon was and is a retail disruption delusion, it did disrupt the mindset and priorities of those who analyze, operate and invest in retail — and continues to do so.”